top of page

Economic News, Articles, and Reports

Economic News -current articles about the economy and its affect on residential real estate

-

Fed's big operating losses 3-22-2025

-

Trump tariffs risky by Tiana WE 3-21-2025

-

Feb eco indicators dwn 3rd mos 3-21-2025

-

Central Banks hesitant lowr rates 3-21-2025

-

Fed March meeting no changes 3-20-2025

-

Tariffs roil Fed's March thinking 3-20-2025

-

Savers borrowers feel squeeze 3-19-2025

-

Falling stocks hurts consumers 3-17-2025

-

Signs indicting a recession 3-15-2025

-

WS and bus got Trump wrong 3-15-2025

-

Consumer sentiment sours 3-15-2025

-

Consumer angst all incomes 3-14-2025

-

Stocks tumble Trump correction 3-14-2025

-

Feb wholesale infla easing 3-14-2025

-

Feb inflation report 3-13-2025

-

High gov debt and inflation 3-13-2025

-

Understand trade vs cap deficits 3-13-2025

-

Liquidation of economy really? 3-13-2025

-

Can consumers to save the eco 3-12-2025

-

Trump bets economy on tariffs 3-12-2025

-

Hard landing fears rising 3-12-2025

-

Trump actions causing recession 3-11-2025

-

Tariffs inflict pain on builders 3-10-2025

-

Do stock prices always rise 3-10-2015

-

Fed Powell no changes up or dwn 3-8-2025

-

Jobs report Feb - good! 3-8-2025

-

US credit rating chng impact 3-7-2025

-

Changing how data to GDP impact 3-5-2025

-

What happens if deficit not fixed 3-5-2025

-

Is stagflation lurking? Meaning 3-5-2025

-

Possible debt crises meaning 3-4-2025

-

Stocks fall tariffs yield drop 3-4-2025

-

Yes, eliminate nation debt ceiling 3-3-2025

-

Budget cuts can trim trade deficit 3-3-2025

-

Trump's 2025 Tax Plan 2017 Act 3-1-2025

-

Jan inflation report good infl down 3-1-2025

-

Green lighting DOGE reconcil bill 2-28-2025

-

Tax bracket creep infla alive 2-27-2025

-

Eco humming well yet gloom 2-27-2025

-

Consumer confidence dwn Eco fine 2-26-25

-

How national debt affects you 2-26-2025

-

How Trump SGEs get paid 2-26-2025

-

Eco still gr8 altho confidence lo 2-26-2025

-

Fed bureaucracy v. Trump DOGE 2-26-2025

-

Consumers pessimistic eco 2-26-2025

-

Consumers wary infl trade trump 2-26-2025

-

DOGE Scalia's best revenge 2-25-2025

-

How national debt affects you 2-25-2025

-

Getting fed debt under control 2-25-2025

-

DOGE demystified explanations 2-25-2025

-

Clinton reinvent gov vs Trump's 2-24-2-25

-

Be careful fed layoffs & job mkt 2-24-2025

-

Wealthier consumers bolster eco 2-24-2025

-

Debt-welfare ratio hurts nations 2-22-2025

-

Leading eco indictors 2-21-2025

-

Trade deficit myths Trump 2-21-2025

-

Jan housing starts decrease 2-20-2025

-

Fed Jan meet no rate change 2-20-2025

-

Trump eco policies dangerous 2-18-2025

-

Lowering hm prices- how 2-18-2025

-

Tariff costs China showing up 2-18-2025

-

Trump sovereign wealth plan 2-18-2025

-

Trump lowering borrowing cost 2-18-2025

-

How Fed interest rates work 2-17-2025

-

Extending Trump tax cut effects 2-13-2025

-

Jan 3% inflation up from Dec 2-13-2025

-

Stocks slide on 3% Jan infla news 2-13-2025

-

National policy more babies idea 2-13-2025

-

Powell says Fed on hold for eco 2-12-2025

-

Trump budget and tax proposals 2-11-2025

-

US consumr confid dwn UofMich 2-8-2025

-

Tariffs as a tool or salve Trump 2-8-2025

-

Jobs report Jan 2025 2-7-2025

-

Bank of England cuts bank rates 2-7-2025

-

Trump sovereign wealth proposal 2-7-2025

-

Trump of 2 minds about tariffs 2-7-2025

-

US trade deficit sets record 2-6-2025

-

US job rpt Dec 2024 no surprises 2-5-2025

-

Trump tariff vs strong-weak dollar 2-4-2025

-

Musk's DOGE seeks US pymt syst 2-3-2025

-

Dumbest tariff war begins 2-3-2025

-

Trump's trade war hurts all 2-3-2025

-

Inflation still lingering EOY 2024 2-2-2025

-

Inflation at end of 2024 still sticky 2-2-2025

-

Dumbest trade war ever Trump 2-1-2025

-

Peggy Noonan on Trump 2-1-2025

-

Inflation still too high for Fed 2-1-2025

-

Nu hm bldr end 2024 and '25 vu 1-31-2025

-

GDP 4Q and 2024 consumers 1-31-2025

-

GDP 4Q and 2024 at 2.8% 1-31-2025

-

Why bond yields R up Fed down 1-30-2025

-

Fed holds rates same in Jan 1-30-2025

-

Stock mkt Fed's Jan no rate chg 1-30-2025

-

Critical look Trump's 3 eco plans 1-28-2025

-

History exam tariff practices 1-28-2025

-

Fed expt'd NO rate chg Jan-Feb 1-28-2025

-

Stock vs bond premium changes 1-27-2025

-

Will Fed drop bombshell on rates 1-27-2025

-

Trump's 1st week Peggy Noonan 1-25-2025

-

National sentiment down UofM 1-25-2025

-

Saudi's promise $600B US invest 1-24-2025

-

Solid US eco hard 2 lower rates 1-14-2025

-

Trump economy issues 2025 1-21-2025

-

Economist can be wrong 1-20-2025

-

Book on Fed at creation 1-20-2025

-

US birth death ratio going neg 1-15-2025

-

Global bond surg driven by US 1-14-2025

-

Bessent's Treasury 3 eco plans 1-14-2025

-

Trump economist 4 tariffs 1-13-2025

-

World wide bond yield problem 1-13-2025

-

Good jobs rpt spurs markets 1-11-2025

-

UK bond yields rising too 1-11-2025

-

Strong jobs report Dec 1-11-2025

-

Tight money coming by Fed? 1-11-2025

-

Mkt fears fuel rise in yields 1-11-2025

-

Expect fewer Fed cuts in 2025 1-9-2025

-

"Hidden Force" help lower rates 1-9-2025

-

Debt ceiling debate left vs Right 1-8-2025

-

National debt debate left vs Right 1-8-2025

-

Jobs report and bad vibe now 1-7-2025

-

Nu US eco depends on small bus 1-5-2025

-

Colo budget tight but good 1-5-2025

-

Review deficits budgets eco 1-2-2025

-

US factories struggle to fill jobs 12-31-2024

-

2024 predictions at end of year 12-30-2024

-

A bond recovery in 2025? 12-30-2024

-

Numbers define 2024 stocks 12-28-2024

-

Fed sizing up Trump for policy 12-28-2024

-

Aging pop 65+ greater than 18 12-28-2024

-

Tiana take Fed rates vs mortgages 11-6

-

Fed stress test not transparent 12-27-2024

-

Cutting deficit EZ not spending 12-27-2024

-

Fed needs to follow its rules 12-26-2024

-

Immigrants adding to our educ 12-24-2024

-

Debt ceiling vote Trump 12-23-2024

-

Fed's favorite Per Cons Exp's 12-22-2024

-

DOGE and spending limits 12-20-2024

-

What happens govt shuts down 12-20-2024

-

Fed doesnt kno what it doing 12-20-2024

-

Trump already threating Fed 12-20-2024

-

Population grow by immigrants 12-20-2024

-

Immigration help US population 12-20-2024

-

Good report consumer spend'g 12-20-2024

-

Fed admits rate mistake Sept 12-19-2024

-

Feds cut rate in Dec 12-19-2024

-

Trump roils the markets 12-19-2024

-

Are low interest rates done? 12-19-2024

-

Amer eco outlooks grim 2 some 12-18-2024

-

Fed Dec cut likely but in 2025? 12-18-2024

-

Scarey frothy stock market 12-18-2024

-

Trump coming eco issues 12-17-2024

-

Fed and rate reductions 12-17-2024

-

Fed and Dec rate change 12-17-2024

-

Fed and Powell Dec vote rates 12-16-2024

-

Banks fight back on fee limits 12-14-2024

-

Investrs shouldn't count on Fed 12-13-2024

-

Are we all Mercantilists now 12-13-2024

-

Little pres can do about inflation 12-13-2024

-

Nov inflation report 12-12-2024

-

US immigration record Biden 12-12-2024

-

Trump tax cuts and bonds 12-10-2024

-

Trump tariff talking policy 12-10-2024

-

Yields and politics - Trump 12-10-2024

-

Tariffs Trump Canada Mex China 12-9-2024

-

America needs 2 retake Eco 1o1 12-6-2024

-

US productivity propels us 12-6-2024

-

Trump rethinks eco power 12-6-2024

-

Bitcoin and EZ money in eco 12-6-2024

-

Fed's independence from Trump 12-5-2024

-

Inflation recent history 12-04-2024

-

Home bldg industry immigration 12-4-2024

-

Trump immigration and job mkt 11-30-2024

-

Laffer Curve vs British eco 11-29-2024

-

Trump vs Fed Policies 11-29-2024

-

Jobless report last week 11-28-2024

-

GDP 3rd Q grows 2.8% 11-28-2024

-

Colo demographic report 2024 11-28-2024

-

Inflation rpt PCE rises for Oct 11-27-2024

-

Fed Minutes caution ratechange 11-17-2024

-

Inflation killed Bidenomics 11-27-2024

-

Debt and Fiscal Federalism 11-27-2024

-

What Bessent means4 tax rate+ 11-26-2024

-

Treasury Sec Bessents to do list 11-26-2024

-

Trumps eco plan inflationary 11-26-2024

-

National debt v stocks infl rates 11-24-2024

-

Stock market v bonds who wins 11-25-2024

-

Two eco goals collide rates debt 11-25-2024

-

Inflation tax cuts hedges 11-25-2024

-

Presidents eco rate history 50yr 11-25-2025

-

Fed's Powell vs Trump on rates 11-20-2024

-

Colo jobs rpt Sept-Oct Svaldi 11-19-2024

-

Why mtg rate up Fed dwn Tiana 11-17-2024

-

Eco impact tariffs deportworkers 11-16-2024

-

Powell speaks cold water rates 11-16-2024

-

Fed cut Dec? 2 articles WSJ 11-16-2024

-

Inflat'n rept Oct okay, T's up 11-14-2024

-

Yields up hurting mortgages 11-13-2024

-

Republican tax spend budget 11-12-2024

-

Bond mkt in focus post-election 11-11-2024

-

Fed cuts rate qtr-pt after election 11-8-2024

-

Election hurt economists most 11-8-2024

-

Fed thinks inflation done-maybe 11-8-2024

-

Borrows not helped yet from cuts 11-8-2024

-

Fed cuts rate Powell to stay 11-8-2024

-

Trump stock soar bonds sank 11-9-2024

-

Trump wins Fed shifts focus 11-10-2024

-

Fed's next move after Trump 11-9-2024

-

Trump affects future markets 11-7-2024

-

Trump win higher rates due2 debt 11-7-2024

-

Fed tax cuts uncertain give growing deficit especially under Trump 11-7-2024

-

Tax cuts likely exten'd Trump win 11-7-2024

-

Dollar resists debt worries T-yield 11-7-2024

-

If 2017 tax cut not renewed 2025 11-6-2024

-

Oct job growth 12K unemplmt 11-2-2024

-

-

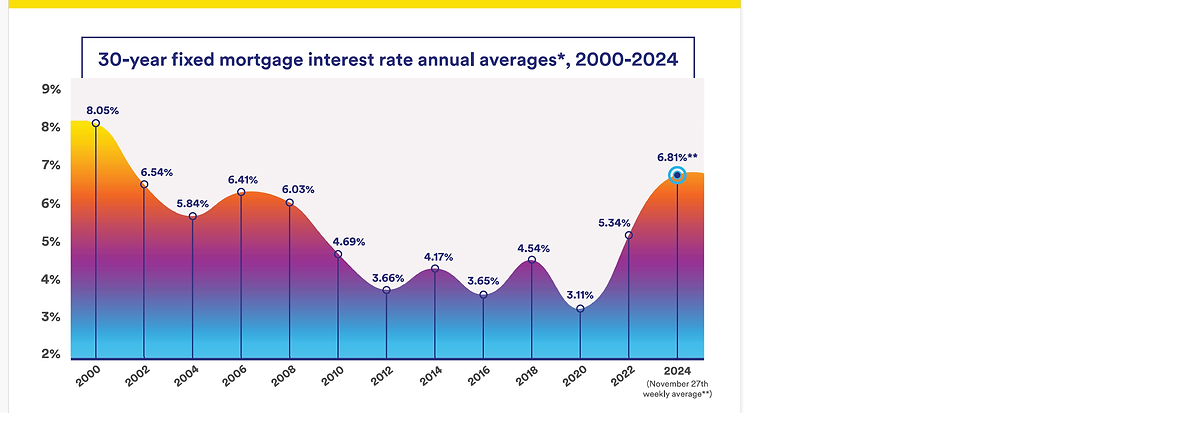

AS OF 2-4-2025, FNMA-Freddie mortgage rates are around 7% up from 6.75% on Dec 22; and miles above its 2-year low of 6.08% on Sept 16, 2024. What's interesting are the FHA-VA rates around 6.125 -- why so much lower?

Bond investors, particularly in 10-year Treasury's, determine mortgage rates through their "yield" percentages buying them. Higher yields reflect concerns over inflation, deficit spending, and national debt limits.

On Sept 16, the bond yield was at a 2-year low of 3.6% when it happened - Trump and Harris started out bidding each other promising greater federal spending.

Cautious investors reacted demanding greater percentage returns, yields, buying bonds. By mid-November, yields were over 4.5% when yields dropped to 4.262% on 11-25-2024, bringing hope mortgage rates would drop too. . They did, but then yields started heading up again. it was good while it lasted.

As of 2-4-2025, the "yield" is at 4.61% bouncing up and down each day. 2025 really won't arrive until Jan 6th when Wall Street and the government get back to fulltime work.

Bonds prices go down as their yield goes up as a percentage.

-

How Fed interest rates work 2-17-2025

-

Understanding yield curves 12-30-2024

-

10 year Treasury notes work 10-30-2024

-

Treasury yields how it works 10-30-2024

-

Deficit spending hurts bonds 10-29-2024

-

Secondary Mtg market works 10-24-2024

-

10 Yr Yield what it is and why 10-24-2024

-

10 Yr T-notes how they work 10-24-2024

What countries-regions import the most to the U.S.? You might be surprised...see below.

Notice the two charts below - the one to the left shows FALLING annual home sales (actual number of closings), and the one to the right AFFORDABILITY - the share of your income needed to cover your housing costs. One is going down, the other up. Yet, incomes are up and beating inflation, jobs are plentiful, and unemployment down. There's a message here that people are not feeling good about the economy...and pulling back.

bottom of page